Troy Taormina-USA TODAY Sports

- Golden Nugget Online Gaming spiked as much as 55% on Monday after DraftKings agreed to buy it in an all-stock transaction worth around $1.56 billion.

- The merging of two online-gaming giants further expands the realms of online casinos and fantasy sports betting.

- The deal, which has been approved by both companies, is expected to close in the first quarter of 2022.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell

Shares of Golden Nugget Online Gaming spiked on Monday after the online casino specialist announced it will be acquired by DraftKings in an all-stock transaction worth approximately $1.56 billion.

Golden Nugget jumped as much as 55%, while DraftKings rose 2%.

The merging of two gaming giants further expands the realms of online casinos and iGaming, which Golden Nugget is known for, as well as fantasy sports betting, where DraftKing is a lead player.

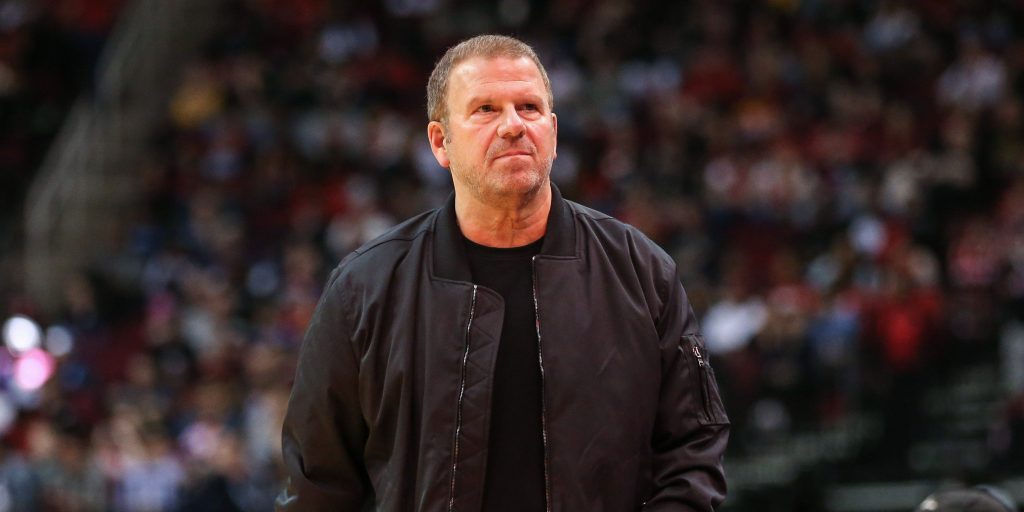

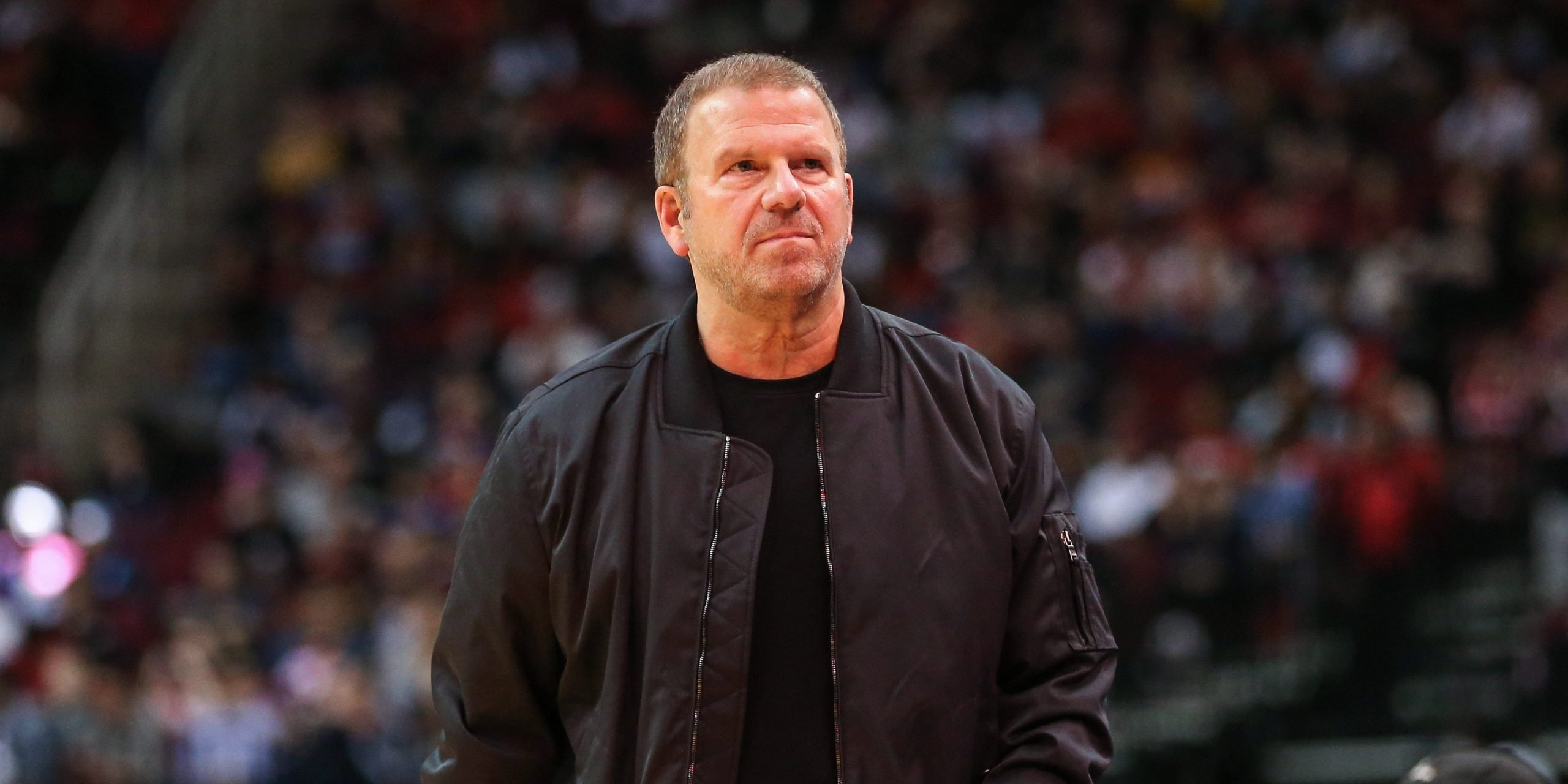

"Together, we can offer value to our combined customer base that is unparalleled," Tilman Fertitta, chair and CEO of Golden Nugget, said in a statement. "We believe that DraftKings is one of the leading players in this burgeoning space."

The acquisition will allow DraftKings to use the leverage on Golden Nugget's more than five million customers. It will also deliver synergies of $300 million at maturity and boost the revenue of the combined companies thanks to cross-promotion opportunities.

The deal, which has been approved by both companies, is expected to close in the first quarter of 2022.

Under the agreement, Golden Nugget stockholders will receive 0.365 shares of DraftKings' Class A common stock for each share.

Billionaire entrepreneur Fertitta, who owns 46% of Golden Nugget, agreed to continue to hold his DraftKings shares for at least one year from the transaction's close. Fertitta took Golden Nugget public through a SPAC merger earlier this year.

Last week, DraftKings lifted its full-year sales forecast and posted second-quarter earnings estimates.